Is Buying a Home and Renting It Out a Good Investment?

By Mario Toneguzzi for REALTOR.ca

Is buying a property and renting it out a good investment option?

Well, a recent CIBC poll of Canadian homeowners found those who own a separate rental property earn on average $2,189 per month – 50% more than their monthly costs.

So it sure does appear to be a good investment option, right?

“It can be if you do your homework. In other words, you’re renting a good property in an area that you can rent out and get a good market value rent. You’re able to cover your costs and you have the time and skills to effectively be a landlord,” says Jamie Golombek, Managing Director, Tax and Estate Planning, CIBC Financial Planning and Advice.

The most important thing is to choose the right property. He says you want to make sure you’re in a neighbourhood where you’ve seen other rentals and you know exactly the amount of rent your place can bring in.

Pro tip: when searching for a property on REALTOR.ca, be sure to check out the neighbourhood and demographics tabs and work with a REALTOR® to help inform your decision.

“You want to get a budget together of what the actual expenses are for that property. Things like the property tax obviously but other things you might be paying for. Insurance and things like that. You also want to get a sense of also your cash flow situation; making sure you can certainly cover your expenses and also planning for the fact you may not have it rented on day one. In other words, can you afford to carry it for a couple of months while you find the right tenant?”

Also, what’s your plan for the long-term for repairs and maintenance? Will you do it yourself? Will you hire a property manager? Will you be paying out of pocket to have someone do that work?

“You have to make sure you have the cash and the expertise to do it. In many situations, people are renting it out and they’re finding it’s really helping with their cash flow,” says Golombek.

He says it’s more popular now because we are still living in a low-interest rate environment. People are able to finance now at a much cheaper rate than they’ve ever been able to do.

In a new report, So, you wanna be a landlord: Tax considerations for rental properties, Golombek and Debbie Pearl-Weinberg, Executive Director, Tax & Estate Planning, CIBC Financial Planning and Advice, address some of the tax considerations for homeowners currently earning or planning to earn rental income.

“While there are many financial and legal issues to consider as a landlord, make sure you don’t overlook tax considerations of earning rental income,” says the report.

“The first question you need to consider is whether the rental income you earn will be treated as income from property (i.e. investment income) or as income from a business since each has different tax implications. When you rent out real estate, your income is treated as property income if you provide only basic services, such as utilities (like electricity and heating), parking and laundry facilities. If you provide additional services, such as cleaning, security and/or meals, then it may be considered a business. If your corporation owns the property, the rental income will be treated as income from property unless the corporation has more than five full-time employees. This is important because active business income in a corporation is taxed at a more favourable rate than income from property.”

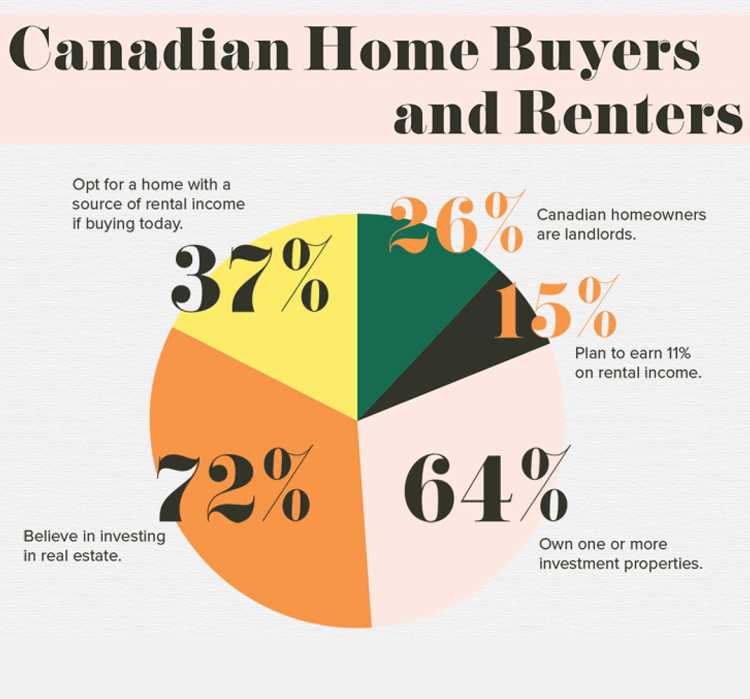

The CIBC poll found that 26% of Canadian homeowners are already landlords (15%) or plan to earn (11%) rental income by letting out space in their primary residence or from a separate rental property. Also, 64% of current landlords own one or more investment property used exclusively for rental income.

The poll found that 72% of all homeowners believe investing in real estate is an excellent way to earn supplemental income and 37% say they’d opt for a home with a source of rental income if buying today.

Golombek says being a landlord can be financially rewarding but a person has to make sure they do their math “and you’re not also buying something which is overpriced… are you buying this for regular cash flow and you want to be cash flow positive? Or, do you have to finance it so much that you’re actually cash flow negative and you’re relying on house prices going up?”

“With very high real estate prices certainly in some major centres, the question is how much does the value have to increase for you for you to make money if you’re not making money on the rent itself?”

CIBC offers five tips for anyone considering becoming a landlord:

• Be clear about your income expectations. You’ll have to pay tax on rental income and expect to spend one to two months of rental income on property maintenance and repairs.

• Invest in the location and condition of your space to attract quality tenants.

• Understand your legal obligations as a landlord as well as zoning and insurance issues for renting out your space.

• Be prepared to spend time and energy addressing tenant concerns promptly.

• Stay organized and keep records of all rental expenses.

If you are thinking about becoming a real estate investor yourself, or you are already an investor and would like to leverage your current investments into more properties, or you are looking to sell one or more of your investment properties, give me a call at 905-683-7800. You can also email me at brian@briankondo.com.

I’ll be more than happy to answer any and all of your questions and help you with all your real estate investment needs.

Thanks for reading today’s BLOG!!!

Brian Kondo

Sales Representative / Team Leader

The Brian Kondo Real Estate Team

Re/Max Hallmark First Group Realty Ltd.

905-683-7800 office

905-426-7484 direct

brian@briankondo.com

www.BrianKondo.com

www.BrianKondoTeam.com

Mario Toneguzzi's article was initially published on Realtor.ca. You can find it by clicking here.

| REALTOR.ca is the most popular and most trusted real estate website in Canada. Owned and operated by the Canadian Real Estate Association (CREA), REALTOR.ca provides up-to-date and reliable information that makes finding your dream property easy and enjoyable. REALTOR.ca is popular with sellers, buyers, and renters and is accessible online and on mobile devices. |

|

Mario Toneguzzi |

About the Author Mario Toneguzzi, based in Calgary has 37 years of experience as a daily newspaper writer, columnist and editor. He worked for 35 years at the Calgary Herald covering sports, crime, politics, health, city and breaking news, and business. He now works on his own as a freelance writer and consultant in communications and media relations/training. |

Homesellers - Find Out What Homes in Your Neighbourhood are Selling For! You can receive a FREE computerized printout of ALL recent Home Sales and Current Listings in your neighbourhood. Click here!

Best Buy Hotlist - You can receive a FREE list of the 10 Best Buys in your

specific price range sent to you at No COST or OBLIGATION.

Click here!

Your Home Sold Guaranteed or I'll Buy It!* No Gimmicks! For a Free Special Report that Details my Guaranteed Sale Program, visit: www.BriansGuaranteedSaleProgram.com.

Remember, your referrals change lives! We donate a portion of our income on every home sale to a great worthy cause like SickKids Hospital. To find out more visit: www.ReferForSickKids.com.

If you or anyone you know is considering making a move in the next little while, give me a call or pass on my number ... 905-683-7800 (Office) or 905-426-7484 (Direct).

#HousingMarket #RentalROIQuestions #BuyRentInvest #HouseHackThoughts #RentalIncomeInsight #LandlordDecision #SmallInvestorTalk #BuyAndLeaseOut #RookieRentalInvestor #RealEstateExitPlan #BuyToRentThoughts #MiniLandlordJourney #RentalHomeMath