Be a First-Time Buyer & Investor at the Same Time!

There’s a new standard for starter homes. Whether in the city centre or in the suburbs, expectations for first home purchases are changing. Square footage and lot sizes are shrinking, and townhouses and condos are becoming the new norm.

Larger homes have less demand than they did a decade ago. It’s not that people don’t want larger homes (though there is a shrinking demand for sprawling houses), but there is a much smaller pool of buyers who can afford the price point of these homes. In cities like Toronto, much of the population is even priced out of townhomes and larger condo units. People are either moving further away, or they’re looking at smaller and smaller homes.

This is happening across much of the province. In the suburbs, condos and townhomes are growing in demand as prices rise and single-family homes are getting too expensive for many first-time buyers. Prices are still considerably lower than in the Toronto core, but neighbouring suburbs have still seen massive percentage increases, which has changed the types of homes people can afford.

Inflation is Normal, BUT...

While inflation is normal, the level that the housing market has seen in the last generation has far surpassed income level growth and has changed the types of homes people can afford. People still need houses, but new home buyers won’t be able to afford the same types of homes as their parents.

Starter homes are the properties most first-time buyers purchase to enter the real estate market. However, these homes are also purchased by retirees, investors, and people who need less space.

The demand is there for the least expensive homes possible, which means smaller dwellings. Developers are matching the demand with more townhome and condo developments going up and far fewer single-family homes.

Today’s first-time home buyer is spending more time working, commuting, and time on the couch watching TV. They aren’t looking for the same time commitment to housework and yard work that previous generations took on with large family homes. People want easy-to-maintain and minimal work from their homes.

Open-concept living isn’t a new trend, but many rooms are being removed from floor plans. This is especially true in starter homes. Gone are the formal dining and living rooms where people hosted dinner parties. Gone are the gardens and yards where summer barbeques were held, where children played, where dogs romped. These new homes are designed for a new generation of homeowners. Busy, young, hard-working individuals who look at a home as a place to sleep and lay on the couch to binge-watch TV.

The busier we become, and the more tied to technology we are, the less houses people need or want. They may want a more high-tech house, but the need for square footage is disappearing. For good or bad, there is a new generation of homeowners, and the new smaller homes are matching the demand of the market.

If you are solely relying on your income to save for the down payment of a home, it is tough. Without some other source of income, your 9:00-5:00 job won’t be enough to get you into your dream home, and possibly won’t be enough to even get you into a house, period.

Look at the median salary in Canada. Right now, the average person is making about $60,600 a year. A single person making $60,000 can roughly afford very little in today's market. A couple, making a household income of $120,000 (both making the average Canadian salary) can afford mid to high $500s, and that’s based on having a 20% down payment.

Anyone making the average salary is priced out of detached homes in many areas. Couples can maybe afford a condo, but nothing larger without moving outside of the city, which either means a complete relocation or they’re now commuting to work.

In addition, many first-time home buyers aren’t entering the market with 20% down. To beat the market, many home buyers are looking to buy as soon as they can, and that means 5%-10% down and paying for mortgage insurance. Even then, home ownership, especially family homes is becoming nearly impossible to afford for the next round of first-time home buyers.

So, Where Does This Leave Investors?

If you already have investment properties, congratulations, you own something valuable!

As the market continues to go up, fewer first-time home buyers will be able to afford to buy, or they’ll only be able to afford a place too small for their needs. That means more young people will be looking at long-term renting. There will be a need for starter homes and family homes up for rent. The need for a place to live is still there, and if they can’t afford to own it, then they are going to rent.

There’s a growing supply of good tenants for your property who will take care of it and treat it as their own. You’ll also have someone else paying down the loan on your asset. Everyone wins!

Homeowner and Investor Hack

We are seeing more first-time homebuyers enter the market using a house-hacking strategy. Often with the help of family, young first-time homeowners are buying properties with 2+ units (or homes that can be converted to have 2+ units). They will live in one unit and rent one out to help cover the monthly carrying costs. Frequently the homeowner is opting to initially live in the smaller unit to bring in a higher monthly income from the rental unit. Entering the housing market as a homeowner and an investor at the same time is a true win-win!

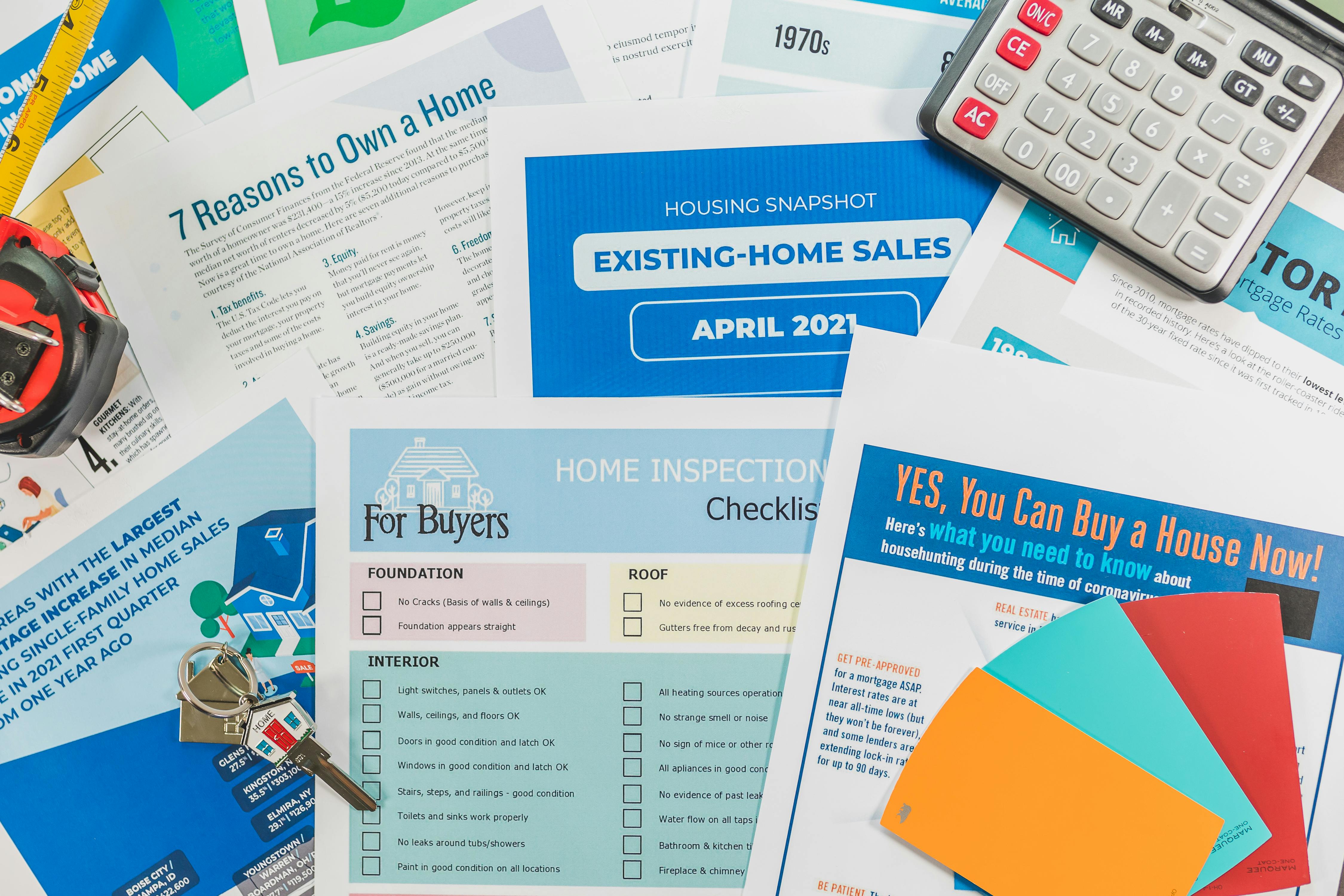

Real Estate Investing is a real business, and you must treat it as such. From finding the right mortgage broker/lender, to making sure you have a good home inspector, lawyer, contractor or property manager, to finally, working with a real estate agent who knows the ins and outs of investing in real estate, it’s important to treat it like a business.

If you are thinking about becoming a real estate investor yourself, or you are already an investor and would like to leverage your current investments into more properties, or you are looking to sell one or more of your investment properties, give me a call at 905-683-7800. You can also email me at brian@briankondo.com.

I’ll be your personal guide and walk you through every step of the investment property buying, maintaining and/or selling process.

Thanks For Reading Today’s BLOG!

If you would like to see any of my previous blog posts, please click here.

Brian Kondo

Sales Representative / Team Leader

The Brian Kondo Real Estate Team

Re/Max Hallmark First Group Realty Ltd.

905-683-7800 office

905-426-7484 direct

brian@briankondo.com

www.BrianKondo.com

www.BrianKondoTeam.com

Homesellers - Find Out What Homes in Your Neighbourhood are Selling For! You can receive a FREE computerized printout of ALL recent Home Sales and Current Listings in your neighbourhood. Click here!

Best Buy Hotlist - You can receive a FREE list of the 10 Best Buys in your

specific price range sent to you at No COST or OBLIGATION.

Click here!

Your Home Sold Guaranteed or I'll Buy It!* No Gimmicks! For a Free Special Report that Details my Guaranteed Sale Program, visit: www.BriansGuaranteedSaleProgram.com.

Remember, your referrals change lives! We donate a portion of our income on every home sale to a great worthy cause like SickKids Hospital. To find out more visit: www.ReferForSickKids.com.

If you or anyone you know is considering making a move in the next little while, give me a call or pass on my number ... 905-683-7800 (Office) or 905-426-7484 (Direct).

#FirstBuyerInvestorJourney #NewOwnerNewInvestor #FirstHomeFirstInvestment #BuyerAndInvestorAtOnce #SimultaneousBuyInvest #DualRoleHomeInvestor #BeginnerBuyerAndInvestor #FirstTimeInvestorHomeowner #FirstHomeInvestmentCombo #BuyAndInvestNewbie